About this Interview

Our next guest is the Founder & Managing Director of Wel.Co - a multifaceted development business specializing in building Australian communities.

The Interview, Andrew Welsh Transcript

*Please note, this transcript was auto-generated and may contain some inaccuracies.

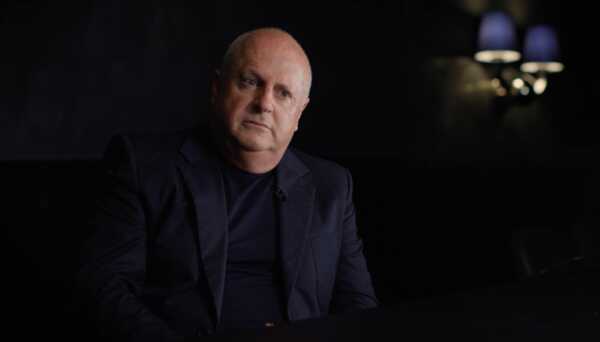

Rob Langton 00:00

Hi, I'm Rob Langton from DevelopmentReady our interview series delves into the lives of Australia's most respected properly thought leaders and decision makers and uncovers what makes them tick. This is The Interview. Our guest this morning is the Founder and Managing Director of Wel.Co, a multifaceted development business specialising in building Australian communities. Andrew Welsh, thanks for your time this morning. Let's start with your background and then move into your current business. Take us through where your interest in property first originated from, was it a lifelong passion you've always had? Or was it something that sort of came later in life?

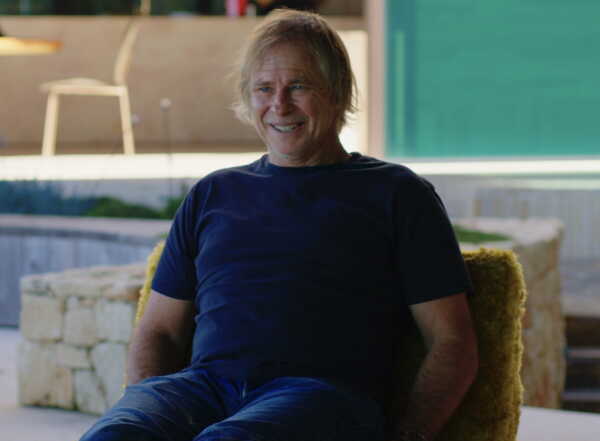

Andrew Welsh 00:34

Yeah, thanks for having me. It's great to, I watch all the previous interviews. So thanks. Thanks for the call up. But look, property for me is always been a real interest and passion I think like, like most Australians have an interest in in property. You know, probably grew for me, as I got older and got more exposed to the construction side, really of property. So yeah, I think early days, yeah, looking at that dream of owning your own home was was something that brought the interest and then I've been lucky enough to turn it into a career from there.

Rob Langton 01:11

And in your former career as an AFL player you played 162 games with the Essendon Football Club and were also made vice captain. Reflecting on your career now, what are the highlights and key learnings you took away from that 10 year career,

Andrew Welsh 01:24

I really enjoyed my time playing professional sport, I enjoyed the the sport side of it, but finishing and moving into, you know, the business life the learnings around, you know, being able to make decisions under pressure, the importance of a real team environment to get a greater outcome is you know, a few of the key areas that have certainly taken from the professional football life into business.

Yeah, you miss that adrenaline rush, you're running and in front of 100,000 people and enjoying the successes of wins and never got to the ultimate and won a flag but but I've got some fantastic football memories. But then also some, you know, some some memories and some learnings that are really carried through post that and, and put me in good stead in the post football life because yeah, I lasted 10 years, most footballs at the professional level, you know, last 12 months or 18 months. So I was very lucky. But But now out in the real world as I like to see post football it's a lot longer of an existence there that you need to make sure that you know all those those key moments that you did go through your drawing on them when when required in in the real world.

Rob Langton 02:32

Now you had business interests in both property, but also a hire company designed to send it site tech while still an AFL player walk us through the impetus for starting a business was it an escape from the football world and that sort of dynamic or was it just capitalising on on your interest in property over the years.

Andrew Welsh 02:49

So I had a general interest just in business itself. So although you know, property was a passion, enjoyed property actually enjoyed business and enjoy understanding how businesses work. So regardless what it was, I was, I was fortunate through my AFL career that I got to do work experiences some pretty unbelievable companies, through the networks or the football clubs. So whether it was with a development business now, whether it was with a marketing company, whether it was with a landscape contractor, that that really gave me an interest outside of footy that. You know, it's so self absorbing and world absorbing the AFL environment. And it needs to be for for many reasons, but to have those outlets was something that I really flourished with and found my football life was a lot better becausite tech were, you know, there was there was people in there the day to day runnings of it. And you know, which allowed me to focus on football where required, and then also business where where was needed as well.

Rob Langton 03:51

And how did you find the transition from being a professional athlete to becoming involved in business? How easy is it to lose that routine and structure that you gain from being an athlete?

Andrew Welsh 04:00

It was quite easy. I think I, I Well, I had a press conference and announced my retirement. And the next day I was on a plane to China where we just purchased another 15 odd containers of temporary fence for the hire company at that time. So I moved on pretty quick on one of routine, like I really enjoy a structure around knowing where I've got to be and what I've got to do, although I'm somewhat a gypsy, when in that structure, I really do enjoy and flourishing knowing what I've got to be doing and when I've got to be doing it so that's certainly carried through on I get told what I have to wear like a polo I need to be wearing for what interview or, or to what function or any of those types of things. Or if the end of my diary the days got to catch up with someone for a beer. I don't have to feel guilty anymore like I did when it was a football environment catching up with someone for a cup of tea. So though there's some of those positives that have changed within what actually sits inside the structure from a footy environment

Rob Langton 04:59

And moving to today this year, you went through a corporate restructure and rebrand. Talk us to talk to us about what the business does who's involved and what your mandate is?

Andrew Welsh 05:09

Yeah. So we, you know, we were primarily in growth areas. Yeah, there's some unbelievable buildings and apartments and office space in, in the city that are not our skill set as a business. Yeah. And we work out there in the growth areas, you know, from residential subdivision developments where we work through whether it's an agent we work with, to secure the property, or we go and secure the properties ourselves from residential perspective, but then also, you know, the commercial retail sector out there and growth areas is a big part of our business as well, which we're seeing is a lot more people moved to these growth areas, these these projects are coming on a lot quicker than you would have anticipated, you know, even 12 months ago, because the demand moving to those markets.

So, you know, we set ourselves as a business that we we own all of our projects to date, but our growth is going to come through new markets. So regional Victoria, southeast Queensland, but also around joint ventures, develop management agreements, where we can provide our skill sets to a range of other parties, and, you know, partnership type models.

Rob Langton 06:19

And as I understand it, the business has five projects underway currently, and obviously a number in the pipeline. Let's start with the $1 billion Armstrong Creek Town Centre Development, how did this opportunity come about? And what's the project brief?

Andrew Welsh 06:32

Yeah, it's interesting the circle of life through footy to where I am now it's I spent a bit of time working with a guy named Mark Casey down in Armstrong Creek. So he was one of the the cornerstones really pushing that precinct structure plan and getting it rezoned into residential land. So this is 15 years ago, that I was working down through Armstrong Creek through the acquisition phase with Mark.

And then as I started developing, in my own right, and the business started to grow the opportunity come for one of the town centre sites. And then from that, sort of, you know, we had the ability to grow and add on more strategic sites around that we just turned it into, you know, a big project for you know, for us, but, but more importantly, a really big project for Armstrong Creek in that greater Geelong area, which, you know, we, we had a pretty tough mandate, opening up Coles centre this year, because of COVID, there was about a period of a month where restrictions got lifted here in in Victoria.

And that was when we got open out if we didn't have that little gap. And a enormous commitment from the team to work, the hours that we did to get the centre open would have been an extremely challenging year for for that project. But we're able to do that. And it's, you know, it's really growing there. From a tenancy perspective, we're getting inquiry for new tenancies every day, which is, you know, a real positive for the challenges that the Victorian markets head, due to COVID.

Rob Langton 08:03

And take us through the delivery program of this project. So far, you sort of touched on it there, but where's it at currently and what are the next stages? Where does it go to from here?

Andrew Welsh 08:11

It's a 15 plus year project. For us, we've only delivered the first stage. So for those listening in so if you think of Ross Hill in in Sydney, or you think of Springfield, or Ryan, which is in SEQ, it's your main street Town Centre model. So they're either midway through or coming towards the end of their total development cycles there and have done an amazing job. And we've learned a lot from, you know, talking to those groups, specifically around the right time and right way to be staging out a project of this size.

For a town centre. We've only just delivered our first stage. So we have the flexibility in the site to actually work with where that demand is going to come from, from the changes of the environment that we're saying that COVID has has brought on so the first stage is anchored by cold. We've got Anytime Fitness, Terry White we've got a Baker's Delight in there, we've got a number of local specialty stores and cafes and restaurants all opening up so there really is becoming a hive of activity for the Armstrong Creek area.

And we're about to start construction on our second stage in in the next couple of weeks, which is a Dan Murphy's, Kentucky Fried and a Hungry Jacks. So we really have been able to start accelerating, accelerating those programs due to demand and and where we go from there. You know, there's LFR components within it. There's industrial, there's residential, it is really a true mixed use Town Centre development.

Rob Langton 09:44

How important is it to think to build the town centre and then attract the residents in the nearby housing stock as opposed to having the housing but no infrastructure to service the residents?

Andrew Welsh 09:54

Yeah, it's a big factor. And it is a big driver of people's Choice around moving to these growth areas what is their existing what what infrastructures there what amenities there, but what is coming and when is it coming a real real drivers. So, that was for us for the greater Armstrong Creek areas. You know a real key to the town centre was showing what we can do and the quality that we can do for the town centre alone which is going to help the greater catchment really develop a lot quicker and if you track the residential markets down in Armstrong Creek their sales not just this year but for the last three to four years have been some of the best in the country the sales right and now with people fleeing Melbourne, CBD for a variety of reasons, whether it's work or or whether it's residents. Armstrong Craig is continuing to grow at astronomical levels, which is really good for the town centre because we can then work in Breen, the amenity a lot on a lot quicker than we would have done previously in a in a northern in a normalised market.

Rob Langton 11:01

I was gonna ask us on that what's your take on the future growth of the broader Geelong region?

Andrew Welsh 11:06

Geelong i've been, really passionate about and bullish for 15 years since I first started working down through those areas, I think the established market, what you're seeing the price growth through there is is fantastic for gelang they come off a reasonable low base. So Geelong was a region for many years just wanted to stay as Geelong was a region that didn't really embrace the growth and all the attractions or Geelong in the great area that that changed over recent years and and they're really saying the economic benefits of doing that the rail system that's Yeah, that's going to be going in connecting Melbourne to Geelong that commutes minimal now. You got the ferry service running out of Geelong which running at a port Arlington straight into Docklands, Melbourne, we're not you know, we're not like Sydney where, you know, you become attuned to travelling Bob water, it's something we're going to have to grow into.

But again, it provides that flexibility of transportation from Geelong and bellarine the surf case surf coast into Melbourne, if you need to work in the city every day a week but you know, things will change post COVID where you may not need to come in five days a week into the CBD it might be two or three and you can easily commute by by ferry or by public transport now for those times if required. So I think we're going to continue to see accelerated growth in Geelong and the growth areas and cancelo doing a fantastic job around making sure there's the right infrastructure and the right available areas for people to come and you know, choose the areas of Geelong or Armstrong Creek where where suits them from a pricing perspective.

Rob Langton 12:44

And let's take a look at the other projects you've got on the go one in particular Thornhill Park, which is an enormous 3000 plus lot master planned community northwest of Melbourne about 40 K's out headed that opportunity to come about and How's it coming along?

Andrew Welsh 12:58

It's coming along really well. We took that that project itself through its own PSP so it was identified as a logical inclusion for residential when minister Wynne coming in after about 12 odd months, we got a ministerial Amendment, which opened up significant growth area which the whole, not just Thornhill Park, but Rockbank, Melton are all seeing the benefits of some really smart planning decisions made there. It's performed really well for us Thornhill Park this year, we'll title upwards of 700 lots in that project alone this year. We've done over 400 sales in that project alone this year. And and it's given us the ability to continue to require an add on further sites to that project, because we're in control of the infrastructure. Because of the the strategic nature, how we set that site up from the start, is going to provide a pipeline for us for a number of years ahead. So it's, no it's a great project and one that's really been supported by that but by that community really well.

Rob Langton 14:01

400 sales in one year one, one developments incredible what's been the driving factor and how much of an impact is the home builder grant had on on getting those sales across the line?

Andrew Welsh 14:12

It's been instrumental to be honest. It's a really what was a challenging time brought a lot of new eyes to the growth area market. And it's not you know, we're not certainly investor driven. Obviously, it's not migration driven. It's really those that have been looking in these growth areas been unsure around. Yeah. Do I really want to move out of my apartment close to the CBD? How am I going to get into work from there? I think the evolution of this year a lot of those, those hindrances have changed where people a lot more looking at how I can get 400 square metres of land, I can own my own little piece of Australia. I can build a three four bedroom house on there. I'm going to have my study to work from home. I'll look at the amenity. I've got shot. centre, I've got a brand new rail being delivered here. The roads out to the west are forever being upgraded and and maybe forever be being upgraded. But a lot of those hindrances are now being overcome by, okay, well, let's go and have a look, now we can, we're gonna have to sit near home, we can actually go out and look at these areas, we're getting great incentives from the government. If you're a first time buyer, you're getting that as well. Developers, builders are providing incentives as well to make it a really attractive and appealing proposition. For those that are looking to have some security around their their future.

Rob Langton 15:37

Do you think the I mean, this, this forecasted population growth will decrease instrumentally over the next, you know, 12, 24, 36 months, but I think from what you've described, you're you're seeing a an exodus of people out from the city into the suburbs? So are you concerned about population growth forecasts and that sort of thing over the next few years? Or you think it'll it's a bit overblown?

Andrew Welsh 15:59

Well, look, it's it's certainly something that you need to be tracking and understanding a lot of a lot of the, you know, so, migration, and when they when migrants move to the country, and how they work through that, that buying cycle into owning their home is a couple of years. But a lot of that is driven by policy, you know, how they get their PR, when it when they when they can get their PR that how can they get the funding together to be able to go to the bank. So there's a lot of these, these hindrances that are just policy driven. So if those policies are refined, then I don't think migration will be huge impact. For the for the medium to long term, obviously, the more immediate, because no one can, can move here and can come to Australia. But but but don't forget, we've had huge migration numbers come through over the last period of time, that are coming into that buying cycle phase. So you know, it's just one of those factors that we're gonna have to continue to track. But then they are investors starting to flood back in the market that we're starting to see, because of, you know, some, you know, some, you know, some compensations around stamp duty, and all these types of items. So there's, you know, there's, there's, for me, not going to be huge shortage of demand. Because the demands always been there, we've probably been under supplied in many ways. So we're just catching up to what that demand needed to be. And we've still got a good couple of years, in my view, until we reach that point anyway.

Rob Langton 17:24

In terms of your project pipeline, what are the key fundamentals or aspects you look at when assessing a site that comes across your desk,?

Andrew Welsh 17:33

A change is a time for me, depending on the market and where projects are adding the market, I think, different to the apartment space in the CBD. Yeah, that's a really big planning exercise to get through there. But once you do that, you've got all your services at your door. So whether it's water, power, gas, whatever it is, in the growth areas, if if you're, if you have to work with five neighbours to bring, you know, whether it's water mains, or you've got outfalls, or whatever it may be, you've got main connected roads that need to go through other properties, they can be real hindrances that just stop your projects. So yeah, assessing sites, we always look at where services are, we look at if there's other developers in the area. Because generally, you can sit down with other developers and work through the best outcome to be able to provide services if it's mutually beneficial. Or if you've got landowners out there that have got no interest in having anyone develop near their site. And then what what temporary measures can be delivered to make sure that, okay, if we're gonna go forward on the site, we need to be able to have temporary measures there that are acceptable to the authorities to make sure we can get out of the ground. So they're probably some of the probably the key ones of the current market. I don't think like you'd do you sit at the start of a pandemic, and you'd assume there's going to be fire sales everywhere. That hasn't happened. There's been some huge money being paid for some pretty big sites out there. Local money. So I think we're gonna see that like, he would have thought that there's going to be for sales around the place, I think it just going to be smart buying in the growth areas is what we're going to see over the next period of time.

Rob Langton 19:15

And how are you finding deal flow at the moment, are you getting sites fed through to you by agents? Or or is there such a shortage that you're having to go direct to vendors?

Andrew Welsh 19:25

So there is there's, there's enough deals out there, but again, it's trying to find the right deal for where we needed to fit into our pipeline gaps. On the big one, because, you know, it's how we brought majority of those sizes is asked getting out and hunting those opportunities with vendors and they take time, it really does take time to work through, you know, the relationship building piece with with vendors, you know, so for us to put together four or 530 acre plots to make one good sized project can take a long time and a lot of businesses just aren't set up to beyond to do that where That's something you know, as a business we really thrive on and always talk to the team around that's, that's where opportunities can present themselves. Because you go to the market or come through an agent, there's any number of developers at the table, where where we've been able to secure some fantastic opportunities, actually, you know, hitting the dirt roads ourselves and walking up the driveways and being told to Nick off and come back next week and just Nick off again, and but but that's part of building that resilience with the team that that's okay to be told to Nick off. But, but but but there are opportunities out there that we're seeing we're we're doing a lot of the work to secure them.

Rob Langton 20:41

Looking at the current environment, where would you see opportunities for growth for the business moving forward? Is development management, a growing area of business? will it continue to be Victorian focused? Or are you saying activities and operations start to ramp up saying in Queensland, southeast Queensland, potentially?

Andrew Welsh 20:58

We're going to go and continue to secure a pipeline under our own under our own ownership. But growth for us is going to come through partnering up with other groups, other groups that have brought extremely well in in the market over the last period of time, but don't have the skill set around executing. So we are getting approached by a lot of groups who've been in that area, which is, you know, which is encouraged us to actually have a look at Okay, well, how can we go out and support and work with these groups, whether it's landowners, whether it's financial institutions that are backed in purchaser, and looking to wrap around some real expertise around them. So that certainly is a growth area for us. And one that's sort of grown organically, really from a lot of inquiry that's come through to us over this year. So that's one area. regional Victoria is one that we're talking to a few landowners in that type of structure development, management, but also new markets. So we've recently secured a site up in southeast Queensland, in the Logan reserve corridor, which now it's a 30 plus million dollar project for us. So we've been canvassing that market for, you know, the best part of two years. Now, these sites specifically since the start of this year, so we got to get in some DD done, you know, walked the site a couple of times pre lockdown, luckily enough, and then, probably the last six months working through those acquisitions has been done remotely. We've got some partnerships with groups happiness, EQ, being able to, you know, go to meetings for us up there. But then also, you know, if there's any servicing info, we actually needed to see for ourselves, get the iPhone out on site, and john would sit and sit there on zoom and work through exactly what we're what needed to plug in where and how to visually it was going to come to offer us. So that's, that's, uh, you know, that's a big growth market for us. And, you know, we've we've secured our first site here and got a couple others in in DD. And now with restrictions lifted again, I'll be looking to get up there in the next week or two, to pursue those ones as well.

Rob Langton 22:58

And when you take sort of a macro perspective on the on the market, whether it's in Victoria, or Queensland, Australia, in general, what are the biggest challenges do you think that developers are facing at the moment?

Andrew Welsh 23:09

So some of them will, they're always the challenges is the funding is some of the challenges there and, and the funding that's available to make your project successful from from from the start, there's a number of funding opportunities, but it's working through Okay, well, how can they work and what strategy can be put together to, you know, to make sure that the the projects have been successful from the start. But, but also, I think the the time of construction has always been a challenge. by Bob, by way of actually getting someone committed to buying their dream block of land to actually handing over the title, in many instances got out to a couple of years, which is a long time, you know, people's circumstances change. So that has been a real challenge. But I'm confident what I'm seeing on the ground on are projects that that's, that has really tightened up significantly, and Winslow, who are one of our larger contractors across the portfolio this year have been instrumental and enormous in really working with with my team on how we can sharpen up that process, which has been a real challenge for us that where we are we're gonna see the benefits of the these moves moving forward in the portfolio.

Rob Langton 24:27

And just on that lending environment, I think you've got a good relationship with Asian based non bank lender OCP. How have they supported your developments in the past and I guess the second part of that is how are you finding non bank lenders v traditional banks at the moment, are you saying traditional banks come back into the market in a competitive way or still a while off?

Andrew Welsh 24:46

Yeah, there is. You know, there's a there's a lot of interest there from from from traditional, but also non traditional bank lenders. Everyone in the market this year, understands yet has acted very cautiously around what are opportunities that are there, I got a fantastic partnership with with OCP. And also Ben Asset Management who won larger funders down at Armstrong Creek. And I've worked with these groups for 677 odd years now. And there's real strategic nature in in how we work through insights, how we worked through the funding structures that are required for projects. And it's something that I've really enjoyed with both of those groups. And, and now we're moving into a new market and SEQ, we don't go and yeah, it's not like we've been sitting from zoom desk this year locked up in Melbourne and saw the sun happening in southeast Queensland. So let's go and buy some sites. Yeah, we've we've worked through that, for a good period of time to make sure when the deals are right, then they stacked up, we can actually move move quick to secure them. So yeah, as I said, in the previous quarter, there's no there's no issue with funding out there. But it is finding the right funding structure to work into any any developers project, which are on Yeah, I'm grateful and thankful that the funding partners I've got have got a good understanding of the development space, and a good understanding around working through where the opportunities will come from in the future.

Rob Langton 26:18

And how do you find dealing with councils, whether it's in Victoria or Queensland? Is there a certain knack you've got to have? Or how much patience do you have to have in in dealing with them?

Andrew Welsh 26:27

I don't think there's a knack if someone's got the knack in the going well. I find I find with with councils in particular doesn't matter which council we're working with. The the old mentality of always combative, combative position with counsel is not the right one to take. Understand that they've got key drivers that they are looking at from their community. We've got key drivers, and we're looking at from our project and for the community that we're trying to develop, and actually work through them. Yeah, functionally, and actually understand that, yeah, going on the front foot all the time isn't the right approach to be taking. Because we've been able to get some fantastic results out of our projects, for our communities, by our to sit down with counsel actually talk through some of the issues with some of the requests that have come back from cancel. But equally, there's things I can say absolutely not, not allowing this is we'll try and work through that piece with them to get them a greater understanding. And if they're not accepting, for whatever reason, okay, we, you know, we move on, because time is money. And we're not always going to win all of them. But if the councils know that when we're coming to the table to talk through an issue, or a change in something that we're there, as a as a more partnership driven conversation, rather than a combative one. Final question.

Rob Langton 27:53

What's next for Andrew Welsh and Wel.CO?

Andrew Welsh 27:56

Look, I think this year has been extremely challenging. Yeah, for the, for the business for society for everyone personally, so I'm really proud of what what the team has been able to pull together this year in extremely challenging environment here in Melbourne, which is really going to provide the platforms and pillars for us to continue to grow. Now I'm 37, I don't want to I enjoy working, I enjoy the property space, I don't want to be retiring. So having really good people around the business this year and bringing good people into the business is going to give us the ability to do that out push hard into these new markets. The develop management space southeast Queensland, yeah, Melbourne, Melbourne growth corridors is is something that I think now people are looking upon what we've achieved as a business this year and what our team has been able to really drive from an outcome perspective which is naturally going to bring new opportunities to the table for us so I'm not looking to sit on a beach anytime soon. I'm looking to you know, continue to build partnerships with with people with groups because we've had some huge successes this year but having a beer on zoom and enjoying those successes yeah it's it's not what we've we've built for so the successes and enjoying with the team. Yeah for me is really highlighted. You know why we won't what why we do these things.

Rob Langton 29:18

Andrew, it's been absolute pleasure having you on thanks for your time.